How to Create a New ACH Batch

An ACH batch is a group of one or more electronic transactions that you send together through the Automated Clearing House (ACH) network.

These transactions can be used to pay employees, collect rent, pay vendors, or move funds between accounts. This guide will walk you through the steps to create a new ACH batch in your business online banking, from naming your batch and selecting the correct settings to adding recipients and saving the batch for future use.

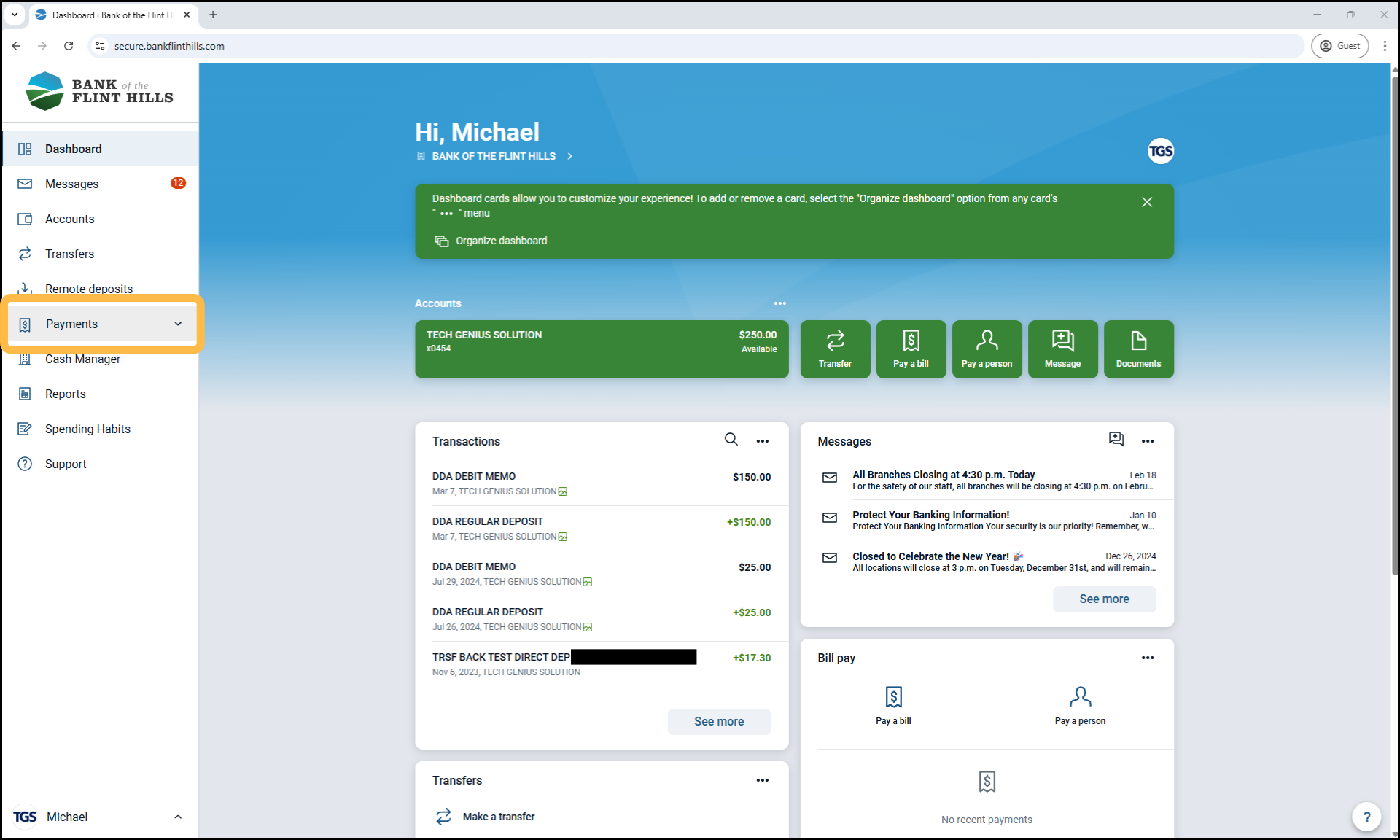

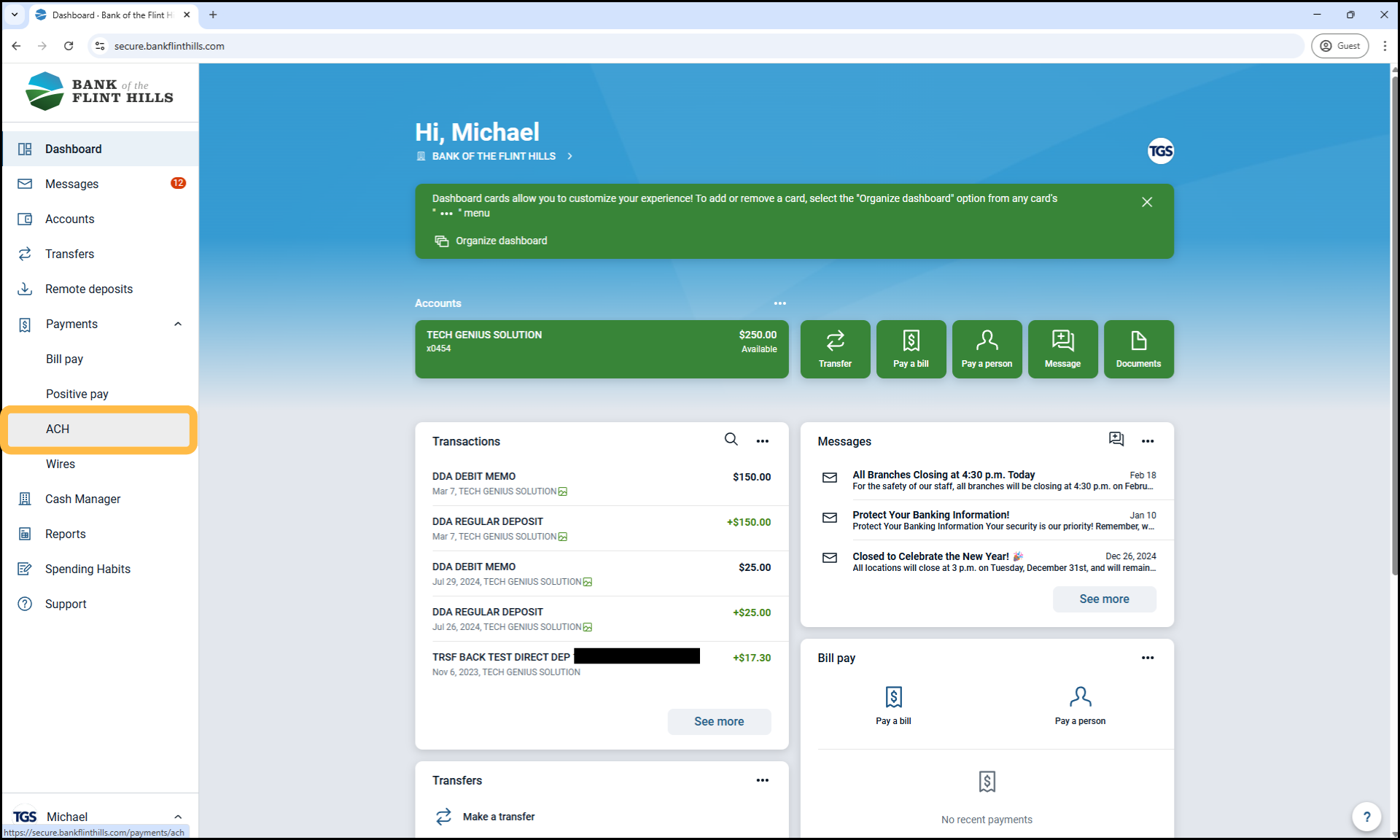

1. Navigate to ACH

From the dashboard, select the 'Payments' drop-down menu, then choose 'ACH'.

Note: If your business only has ACH enabled, it may appear directly in the main menu rather than under the 'Payments' section.

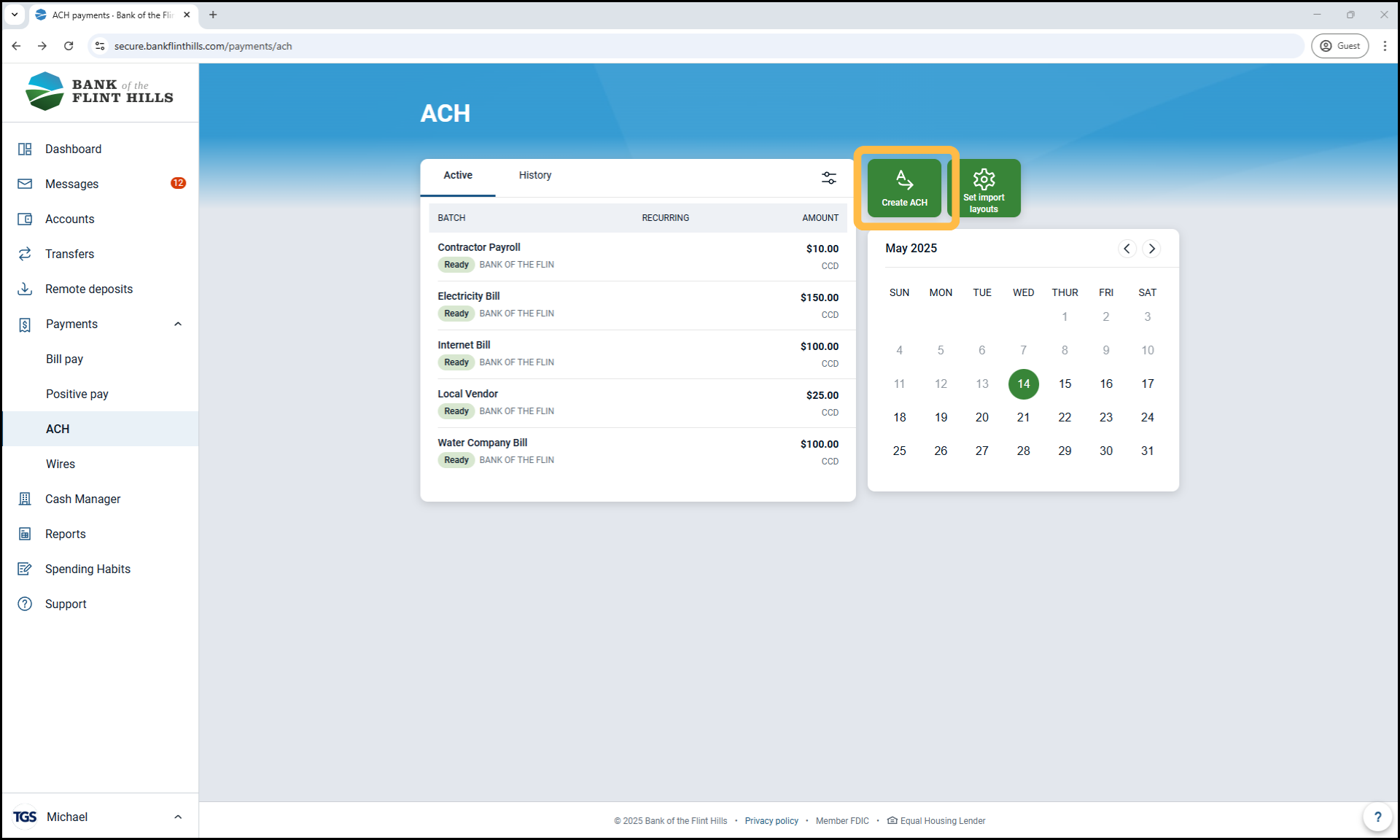

2. Click 'Create ACH'

This opens the setup screen to build your new batch.

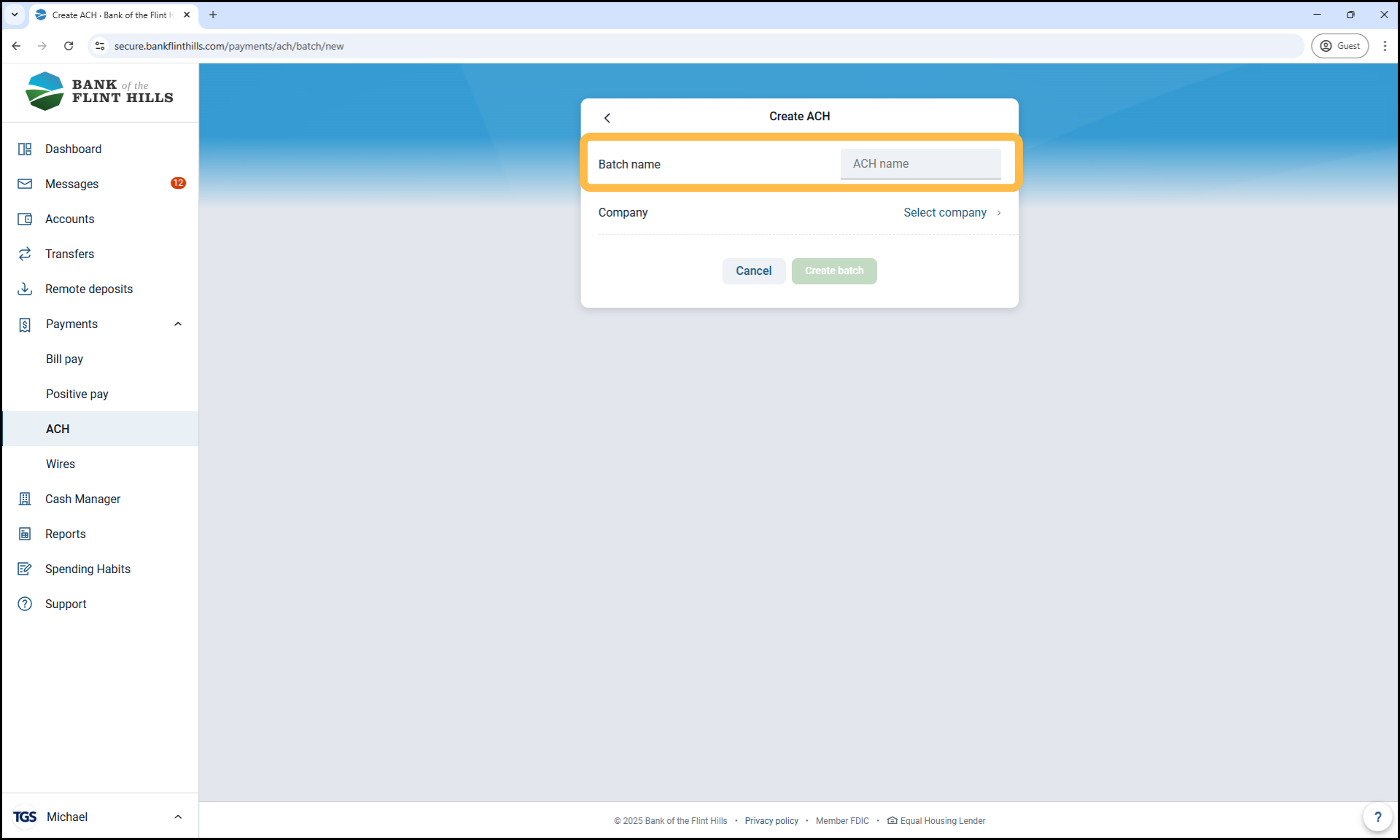

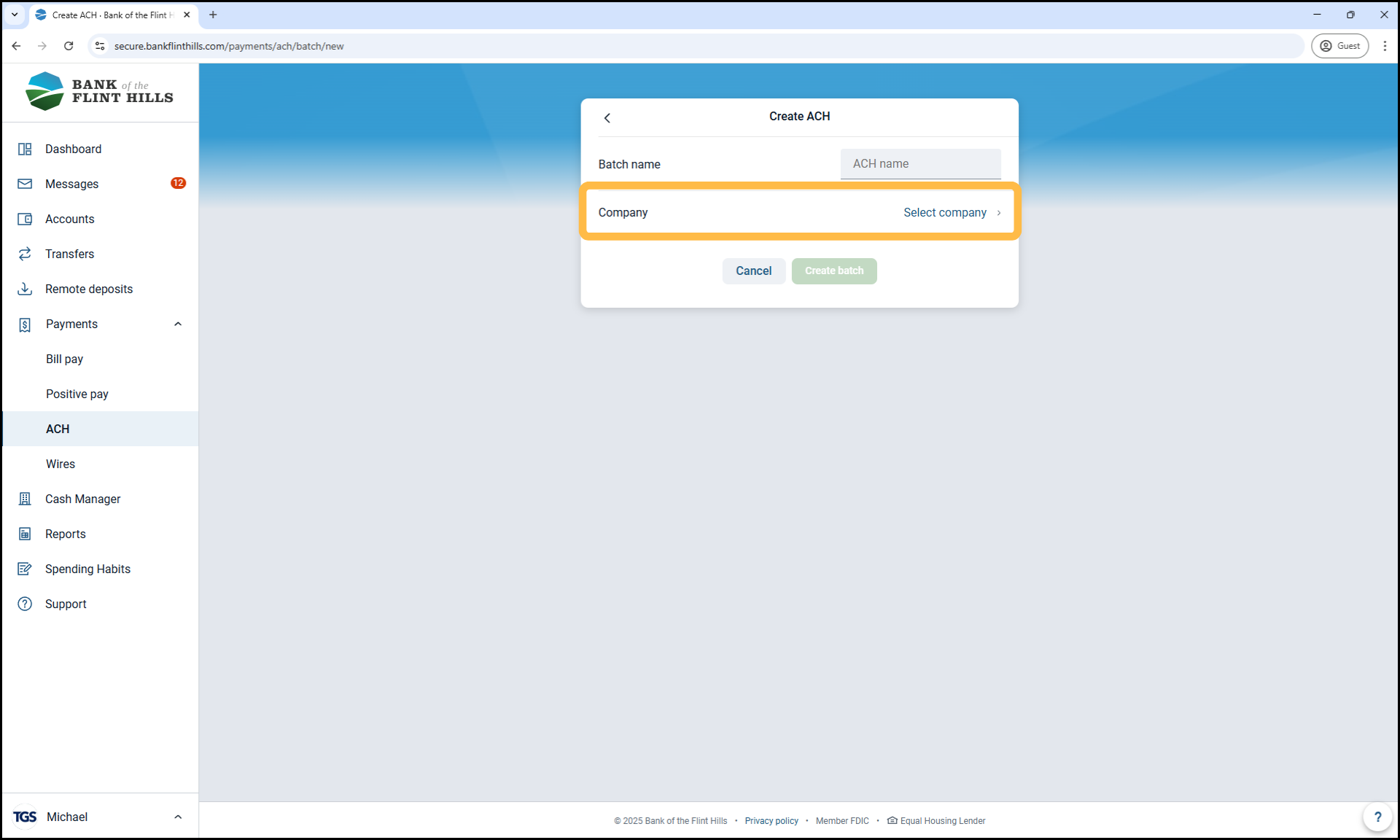

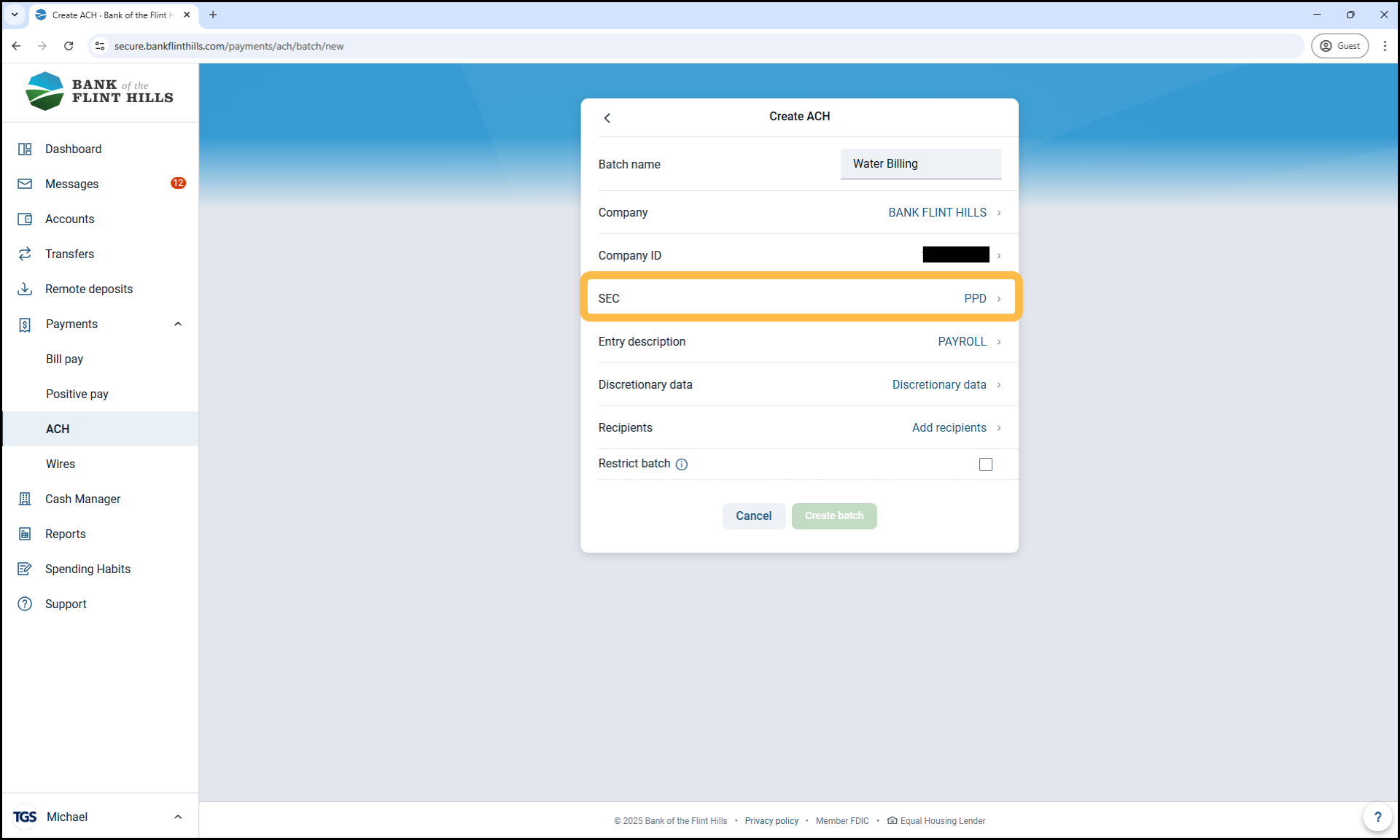

3. Enter a Batch Name and Select a Company

Batch Name: This is an internal label to help you recognize the batch later. Choose something descriptive like 'May Payroll' or 'Vendor Payments 5/14'.

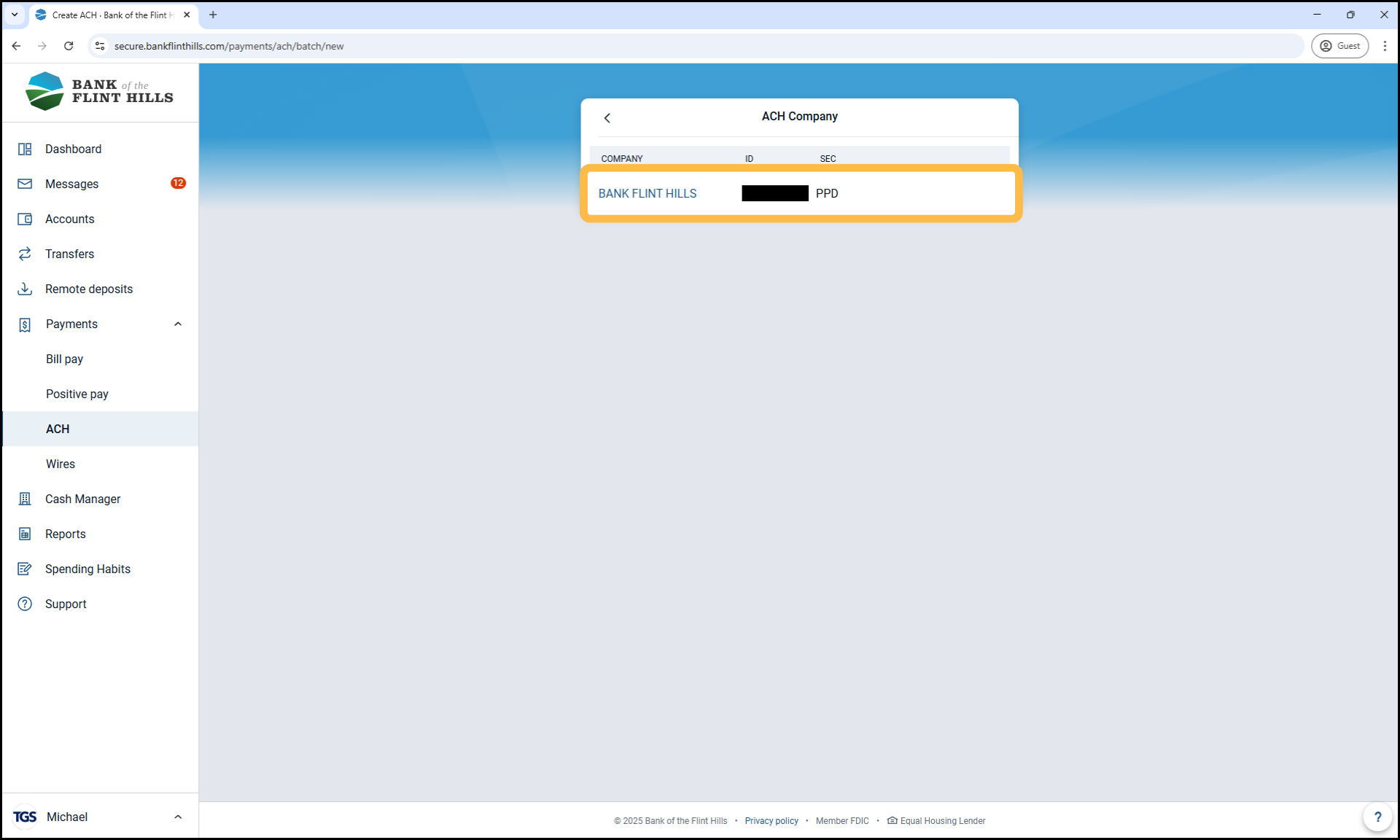

Company: Select the appropriate company from the dropdown list.

The Company ID will auto-fill based on your company selection. Do not modify this value.

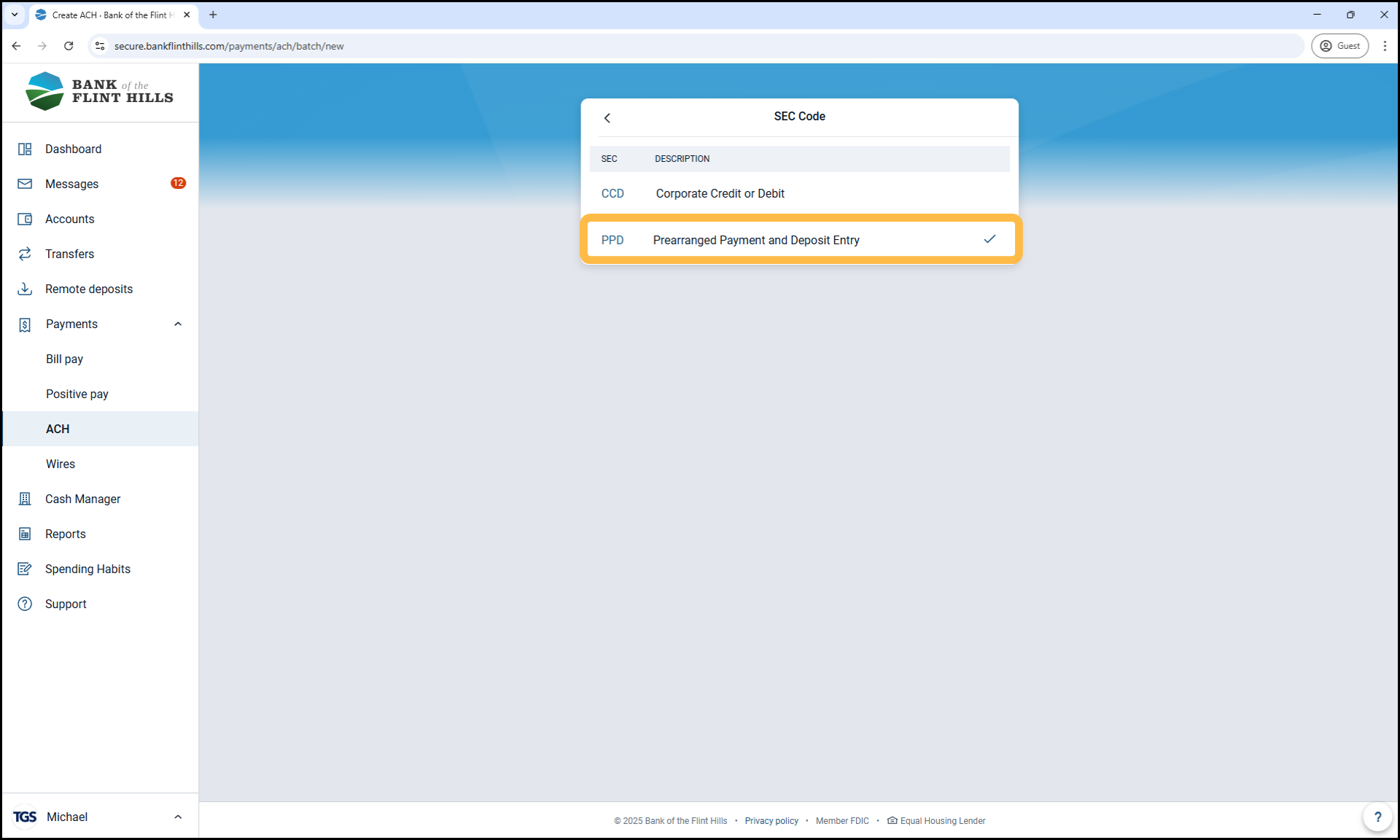

5. Select the SEC Code

Choose the correct SEC Code for your batch:

CCD – Use for business-to-business transactions

PPD – Use for transactions involving personal accounts (e.g., payroll, rent collection)

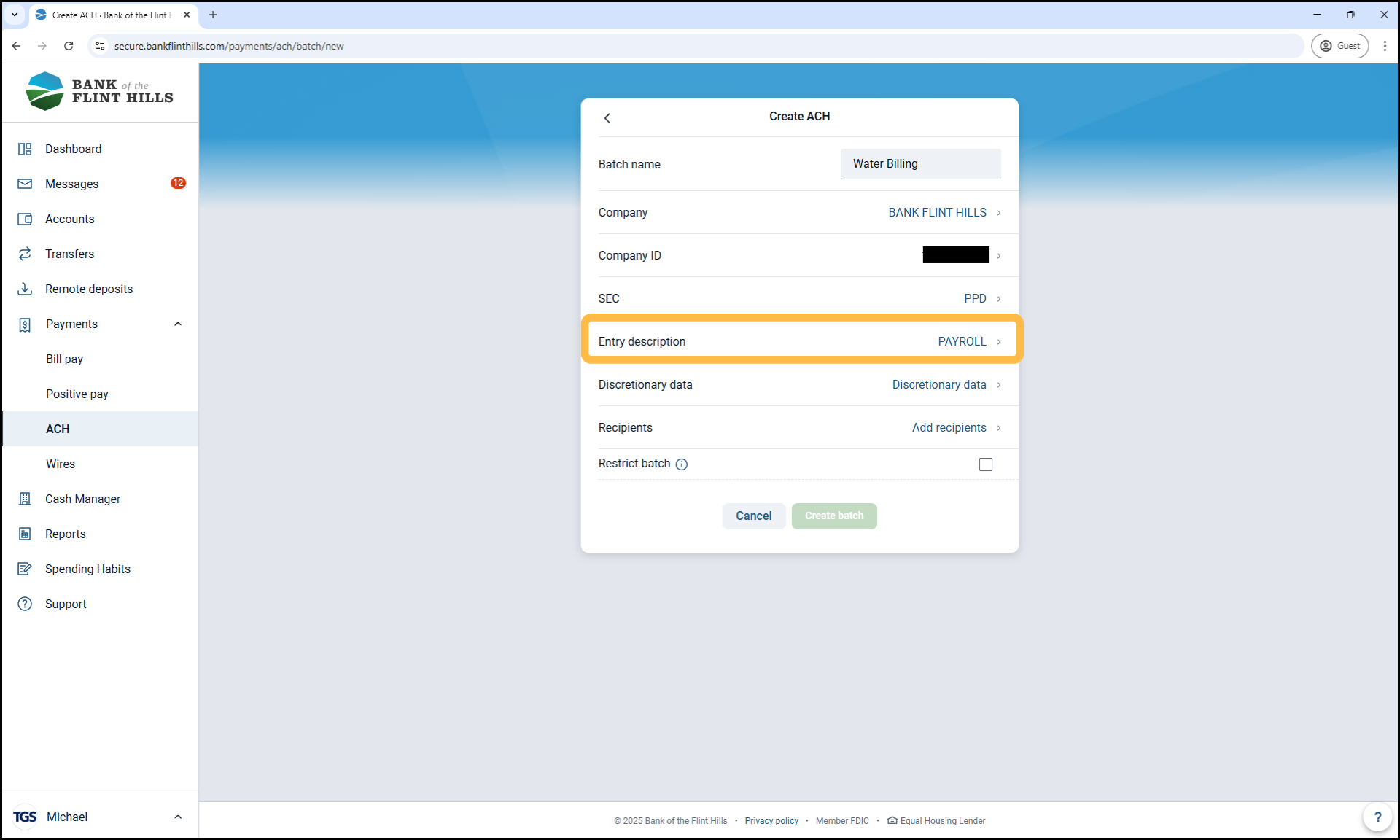

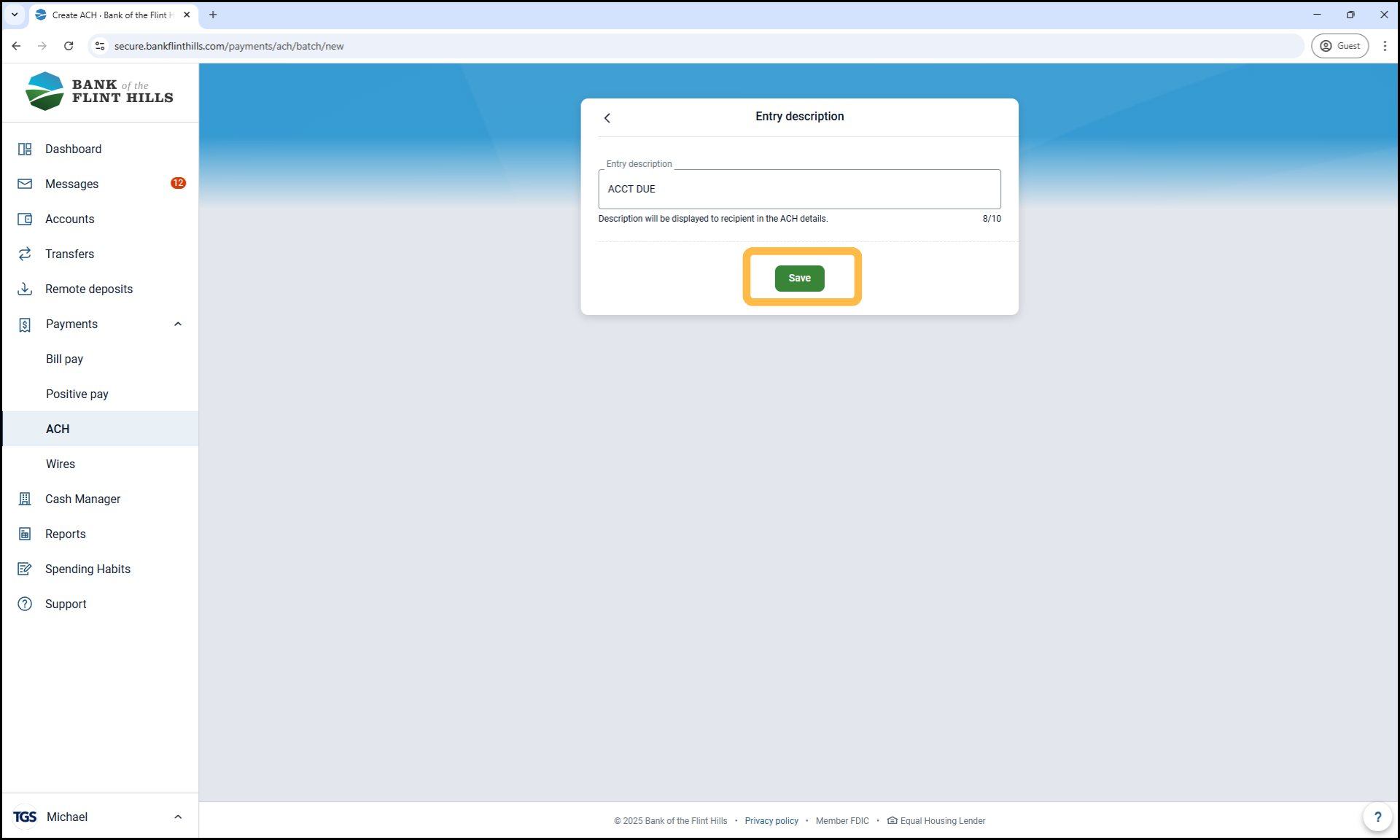

6. Review and Update the Entry Description (Optional)

You can update the batch description to something more specific or meaningful for internal tracking.

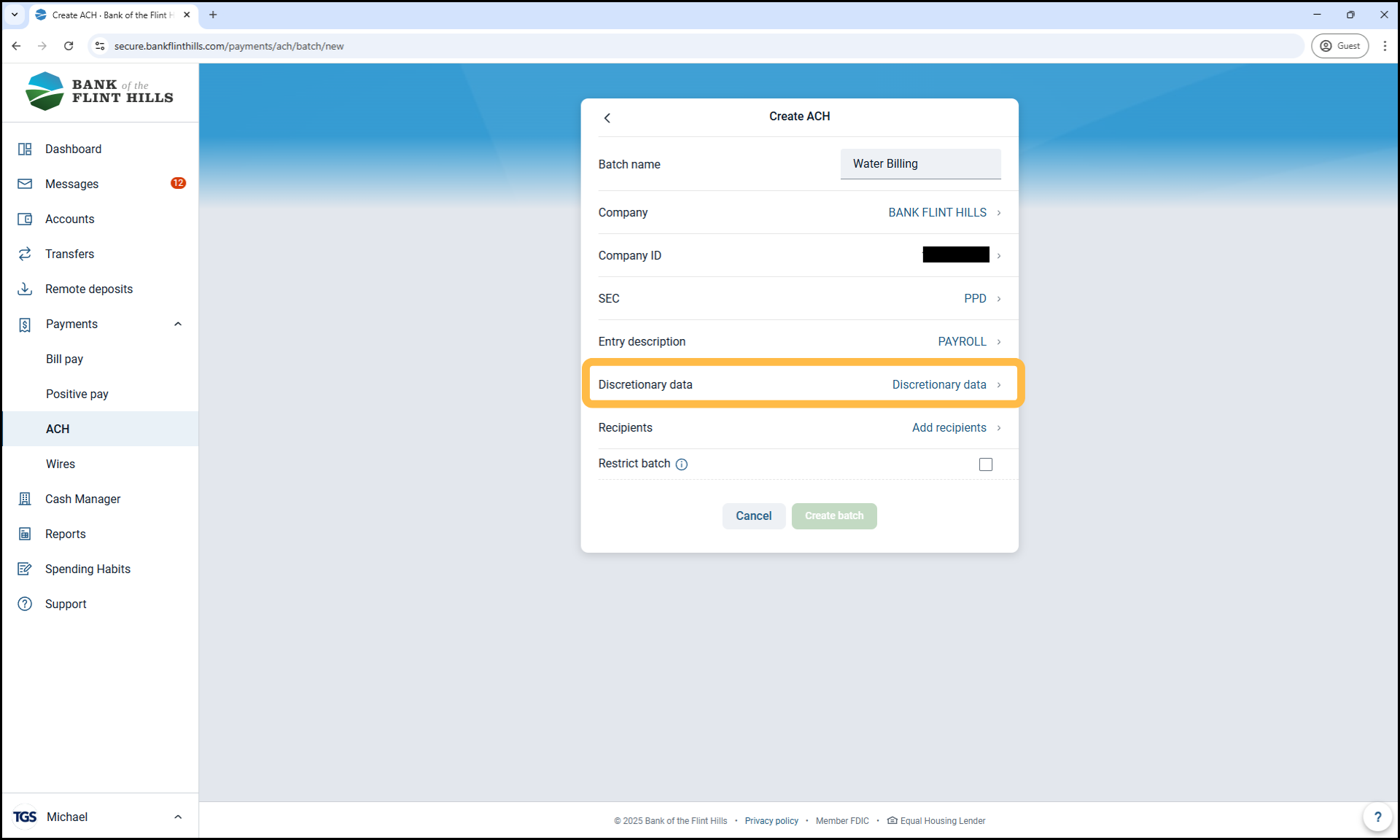

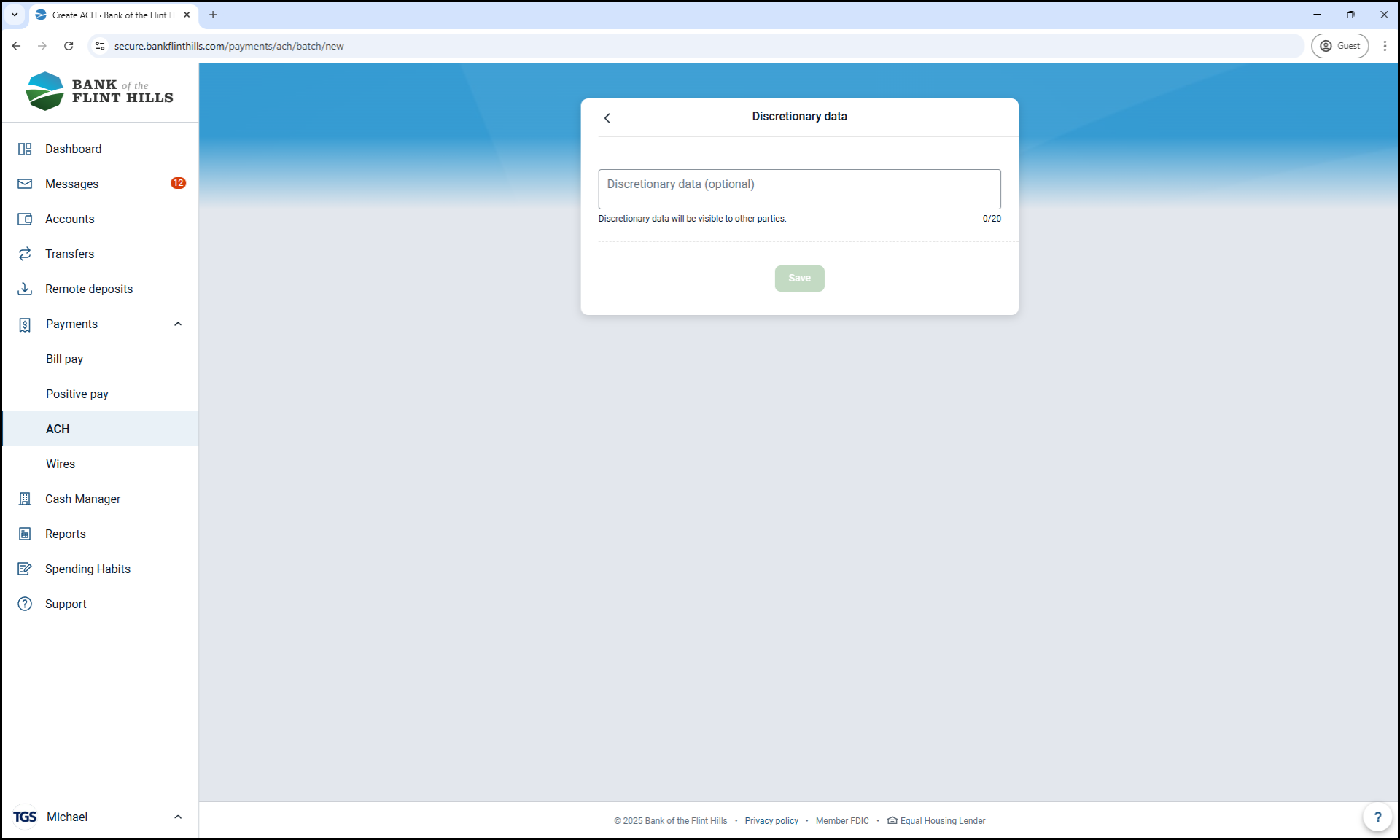

7. Add Discretionary Data (Optional)

This field can be used to include internal notes or additional information for your business records.

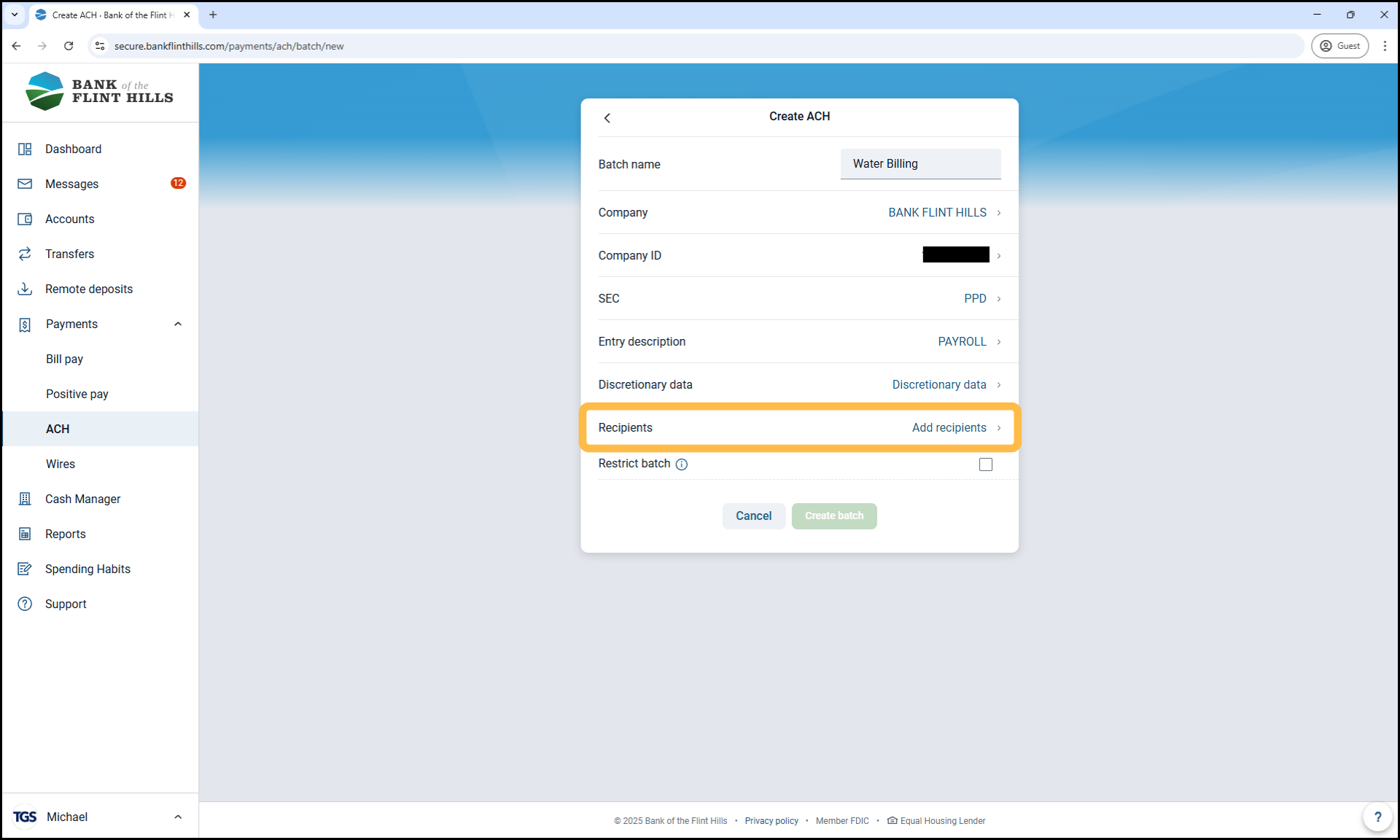

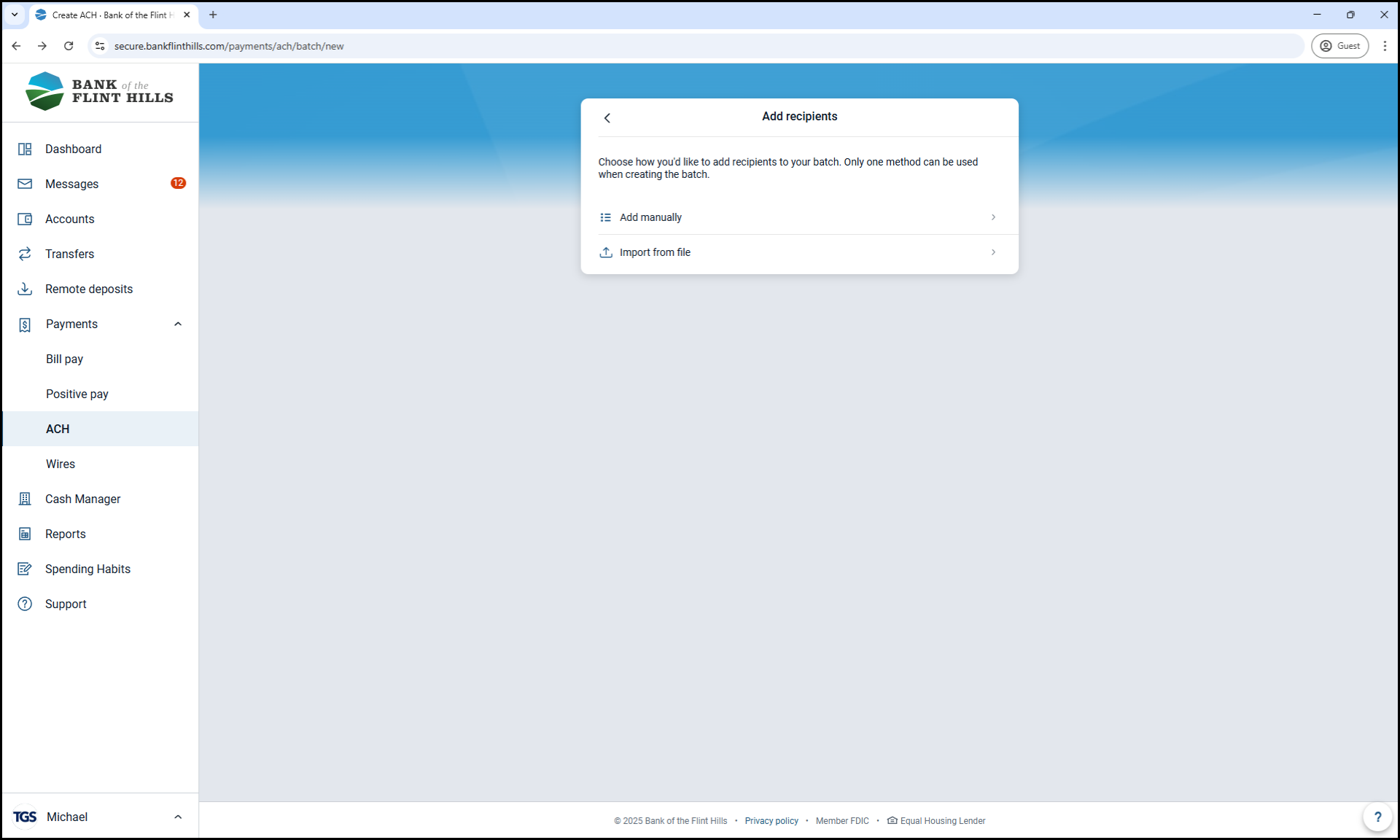

8. Add Recipients

There are two ways to add recipients to your batch. If you have a NACHA file created by another system, you may choose 'Import from file' to complete this step. Otherwise, select 'Add Manually' to input your batch recipients.

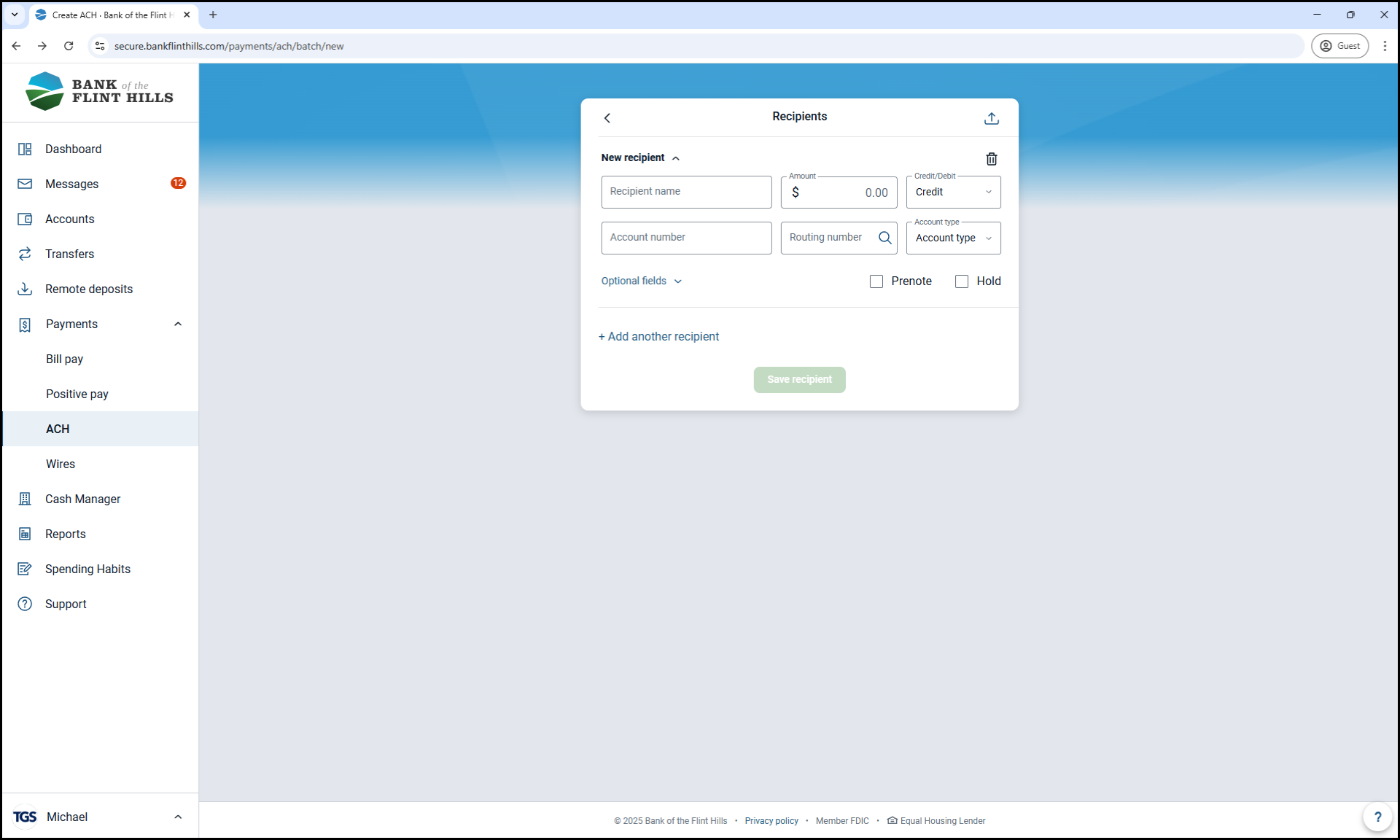

Fill out the recipient information as needed.

Required Fields:

Recipient Name': Full name of the individual or business

Amount: Dollar amount of the transaction

Credit/Debit: Choose whether to:

Credit – Deposit funds into their account

Debit – Withdraw funds from their account

Account Number: The recipient’s account number

Routing Number: The recipient’s bank routing number

Account Type: Identify the account as 'Checking', 'Savings', 'Loan', or 'GL'

Optional Fields:

ID Number: Useful for employee/customer IDs in large batches

Addenda: Additional information to include with the transaction

Prenote: Select this to send a $0 test transaction before actual funds are sent

Hold: Use this to exclude a record from the batch while keeping it saved for later

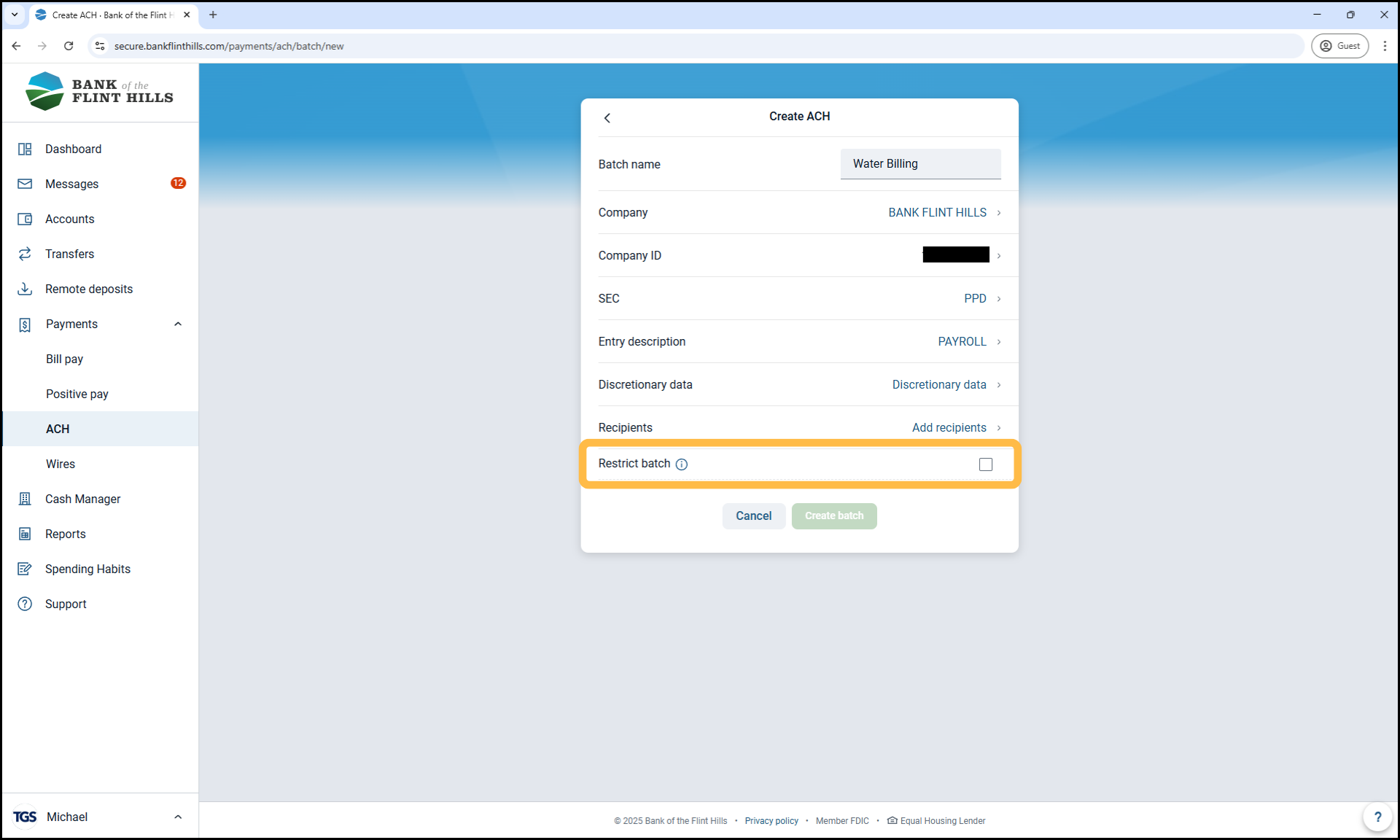

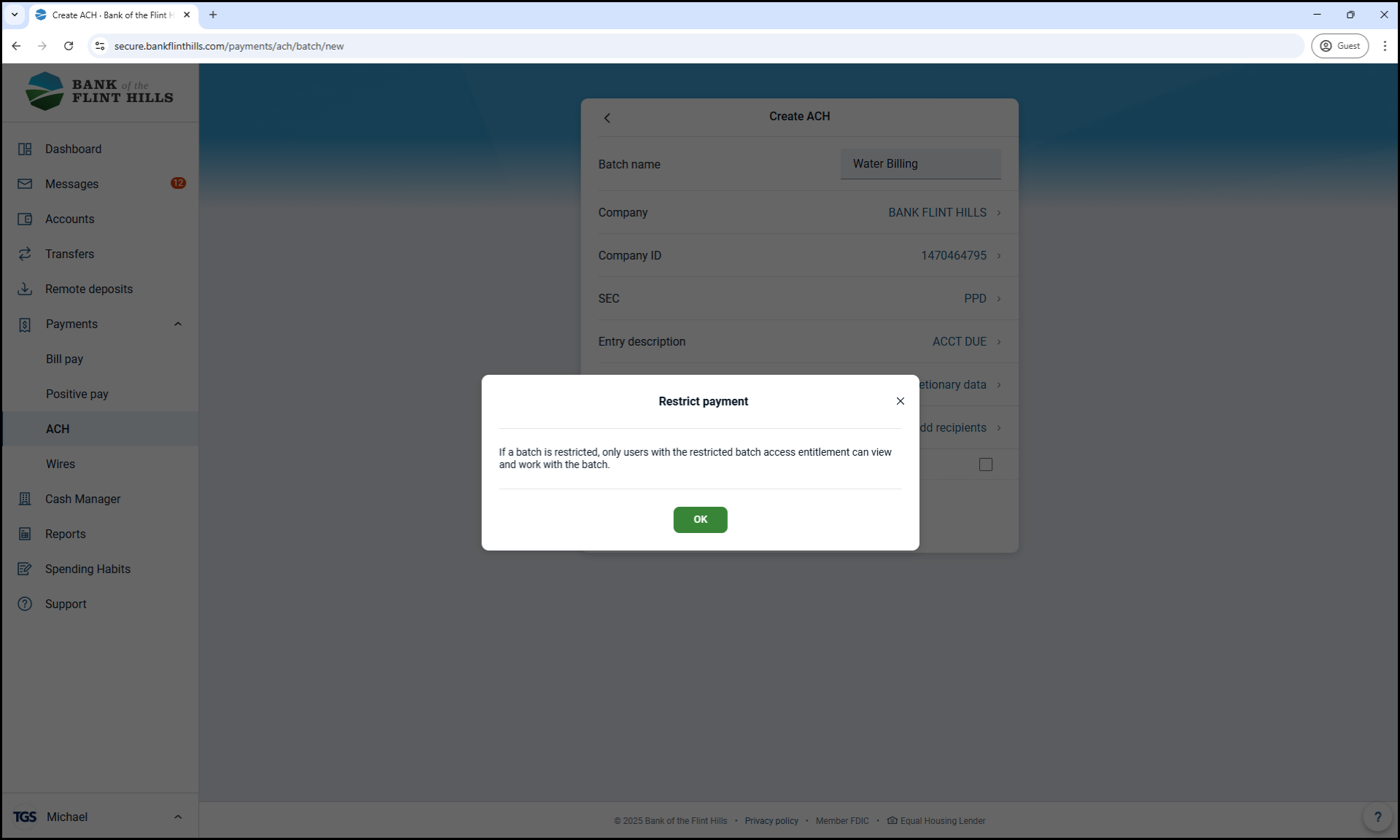

9. (Optional) Mark the Batch as Restricted

If you have the necessary permissions, you can mark the batch as 'Restricted'. This will hide it from users who are not authorized to view restricted batches.

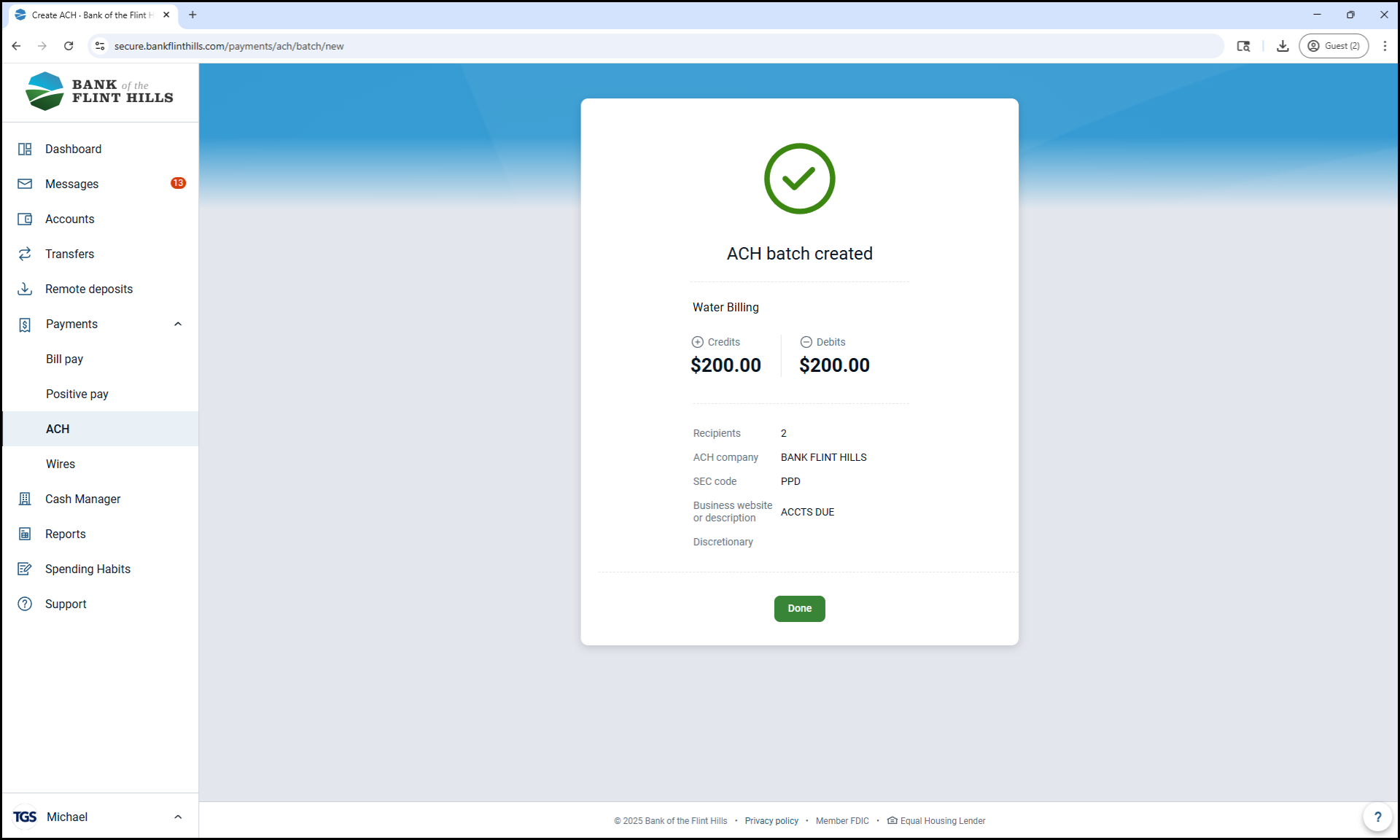

10. Click 'Create Batch'

This saves your batch and adds it to your ACH batch list for future use or initiation.